Form 15G is a declaration to ensure that no TDS has deducted from the income and it can be submitted by individuals of India whose age is below 60 yrs.

Form 15G & Form 15H: Download, Fill, Submit to Save TDS on Interest. If the total yearly income, including the interest earned from deposits, is lower than the annual taxable limit, then you can request your bank to seek exemption or immunity from TDS by submitting Form 15G. Senior citizens should submit Form 15H. Reader can download the latest Form 15G and Form 15H in Excel, Word and PDF format from the links given at the bottom of the article. Form 15H:- Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more (Sixty Years from A.Y. 2012-13) claiming.

Form 15g In Word Format For Ay 2022-23 Download

We need to submit this form 15G to banks whenever we are getting an interest amount of above 40,000 Rs from the FDs and also for PF withdrawals if the total PF claim amount is more than 50,000 Rs and service is below 5 years.

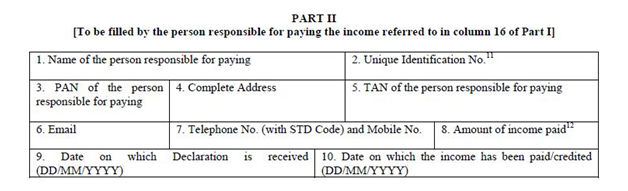

Comply with our simple steps to have your Form 15g Download In Word Format well prepared rapidly: Select the template in the catalogue. Enter all necessary information in the required fillable areas. The easy-to-use drag&drop user interface allows you to add or move fields. May 10, 2009 Form 15G up to A.Y. 2012-13 Form 15G WEF A.Y. 2013-14: Excel Format – Word Format: Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more claiming certain receipts without deduction of tax: Form 15H up to A.Y. Form 15H WEF A.Y.

If you are looking for Form 15G in Word format then you can download below form 15G in Word format.

Can I fill 15G form online

Some major public sector banks and private banks are providing an option to submit form 15G online for fixed deposits. For that you need to login in your bank’s internet banking website there you can see an option to submit form 15G.

Example : in SBI Internet Banking

The best thing of filling form 15G online is there is no need to write every detail manually, all your details will be selected automatically you just need to select the financial years only.

Difference between Form 15G & 15H

Form 15G is for the individuals whose age is below 60 years and form 15H is for the individual whose age is above 60 years. Both are to ensure that no TDS is deducted from the incomes of the individuals.

What is form 15G for PF withdrawal

EPF members need to submit form 15G whenever the PF claim amount is more than 50,000 Rs but their total service is below 5 years, in remaining cases there is no need to submit form 15G.

Form 15g Download Pdf

To submit form 15G online, the PAN of the EPF members must be linked with their PF account.

What happens if form 15G is not submitted

If you don’t submit form 15G even though you are eligible then TDS will be deducted unnecessarily from your interest income or PF claim amount. In some cases EPFO will reject your PF withdrawal application if you don’t submit form 15G.

What is estimated income on form 15G

It Form 15g In Word Format

Estimated income on form 15G means the amount for which you are submitting it. For example if you are submitting form 15G for Fixed Deposits then mention the estimated interest amount for the financial year.

(Or) If you are submitting form 15G for PF withdrawal then mention your PF claim amount and you don’t need to include pension amount in form 15G.

Form 15g In Word Format For Ay 2019-20

Also Read